AI is entering its next phase: shopping agents. Amazon, OpenAI, Perplexity, and other tech giants have recently launched AI shopping features designed to transform how we buy online. These agents promise to research products, compare prices, and complete purchases on our behalf - all without human intervention.

Yet despite billions in investment and significant improvements in LLMs, these shopping agents are consistently failing to deliver on their promises. Why?

The fundamental problem lies not with the AI agents themselves, but with an invisible barrier: payment infrastructure designed for humans, not machines. The entire payments industry was designed to prevent automated usage. Card networks, issuing banks, commerce front ends and other infrastructure providers that are associated with a single transaction each have their own anti-bot mechanisms. This infrastructure mismatch creates a critical bottleneck that prevents AI agents from reaching their full potential.

Let's dive into why the future of AI agent commerce demands a new financial infrastructure – and why the most promising solution will unlock new revenue streams for AI agent companies.

Failed Attempts and Frustrated Users

The evidence of infrastructure mismatch is already emerging in real-world testing:

TechCrunch's evaluation of Perplexity's AI shopping agent revealed a frustrating reality: what should be instantaneous purchases took between 3-8 hours to process, with frequent transaction failures. When attempting to buy simple items like toothpaste, the first order was canceled after hours of waiting because the item was "sold out" - despite being available on the retailer's website.

Amazon's "Buy for Me" feature attempts to solve this by handling payment credentials directly, but creates new concerns about security and control. As TechCrunch noted, users must trust the AI agent "won't accidentally purchase 1,000 pairs of socks instead of 10" - a legitimate worry given AI's susceptibility to errors.

These frustrating experiences stem from five fundamental incompatibilities between AI agents and traditional payment infrastructure:

- Anti-bot barriers: CAPTCHAs, two-factor authentication, and other security features deliberately block automated transactions

- Hyperactive fraud prevention: Banking algorithms flag AI purchasing patterns as suspicious, triggering blocks and manual reviews

- Excessive fees: Credit card processing fees (2-3%) create unnecessary costs for agent-driven micro-transactions

- Settlement delays: Traditional banking transfers can take days to settle, preventing real-time agent operations

- Identity verification hurdles: KYC/AML requirements create impassable friction for AI agents acting on behalf of users

The Problem with Traditional Payment Methods for AI Agents

AI agents purchasing goods and services for users should work as expected for the end user, yet the payment infrastructure limitations represent a critical bottleneck that prevents the technology from delivering on its promises.

For example, across all card transactions regardless of the method, there lacks a framework for handling chargebacks. Is the user, the agent or the merchant responsible for handling chargebacks? At Crossmint, we take on card fraud risk for AI agent companies and offer full stack agentic finance solutions so they can continue focusing on their core business.

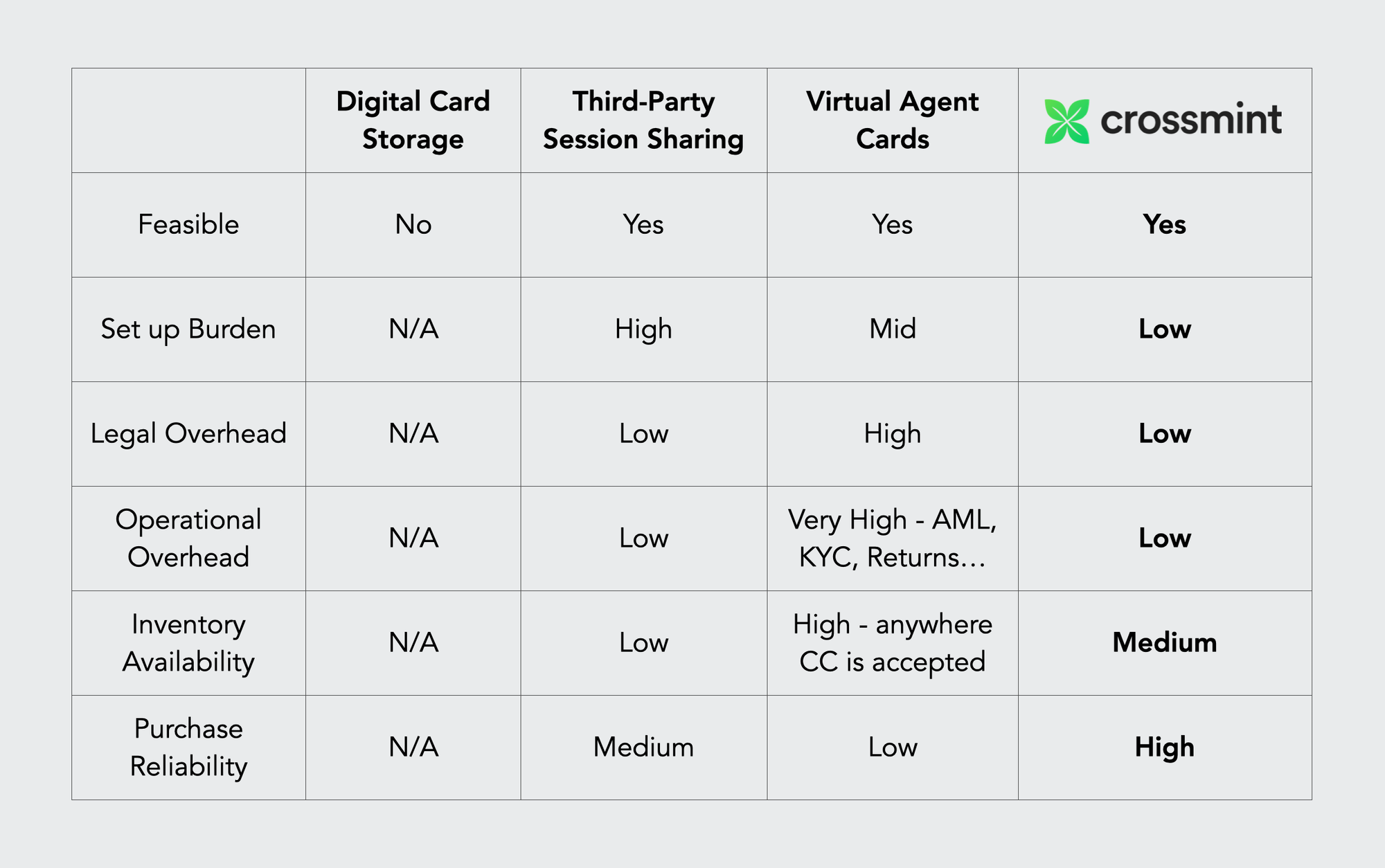

In addition to chargeback risk, there are many problems that are unique to using direct card storage, third-party session sharing and virtual agent debit cards for agentic payments. Let’s dive deeper into the different payment methods used today by AI agents and why they fall short:

Direct Card Storage

The most straightforward approach—having users save credit card information directly with the AI agent—immediately hits a regulatory wall which makes this approach not feasible.

- Regulatory roadblocks: PCI compliance explicitly forbids the storage of security codes and places extreme restrictions on storing card numbers themselves

- Security barriers: Challenges navigating captchas, 2 factor authentication, 3D Secure authentication, and other protective measures designed to prevent automated purchasing

Third-Party Session Sharing

Another approach that requires users to save their payment information with every merchant they might want to interact with and then share access credentials with the AI agent.

- Limited coverage: Users must pre-configure every potential shopping destination (e.g. Amazon)

- Restricted compatibility: Only works with websites that support saved payment methods

- Authentication barriers: Cannot function on sites requiring two-factor authentication or additional security verification

- Poor scalability: Each new merchant requires additional setup by the user

Virtual Agent Debit Cards

Some companies have explored issuing virtual debit cards to their AI agents, allowing them to make purchases after charging the user's saved card.

- Regulatory complexity: Companies must become card issuers with all associated compliance requirements

- Legal overhead: Must act as Merchant of Record for all purchases

- Operational burdens: Implementation of KYC/AML programs, sales tax management across jurisdictions

- Financial risk: Assumption of liability for all customer disputes

- Technical limitations: Remains vulnerable to merchant security measures blocking automated purchases

The Solution: Crossmint Headless Checkout

Crossmint Headless Checkout is a REST API that allows an AI agent to pay for goods or services programmatically, not subject to captchas, anti-botting or bank blocks - which enables AI agents to offer high purchase reliability to their users. Users simply save payment information once with their AI agent and authorize charges for "credits" used in online purchases. At purchase time, the AI agent completes transactions via API using those credits.

With Crossmint Headless Checkout, AI agents:

- Have access over 1 billion products in Crossmint’s growing catalog across Amazon, Shopify and more

- Are not the Merchant of Record, so Crossmint handles returns, chargebacks, etc. on their behalf

- Use one API for everything they need to enable agentic commerce

- Can take platform fees on all sales

Agentic commerce is here and one of our goals at Crossmint is to give AI agent companies a payment infrastructure (complete with wallets, onramps and compliance) that unlocks new revenue streams, provides their users with the best AI shopping experience and gives them a competitive edge to be a leader in this growing vertical.

If you’re an AI agent company looking to enable agentic commerce, reach out to us here.