Stablecoin transaction volume hit $33 trillion last year. 96% of major financial institutions say they're adopting stablecoins by 2027. The question has shifted from "should we integrate stablecoins?" to "how do we do it without wasting six months and making costly architectural mistakes?"

Top Stablecoin Use Cases for Fintechs

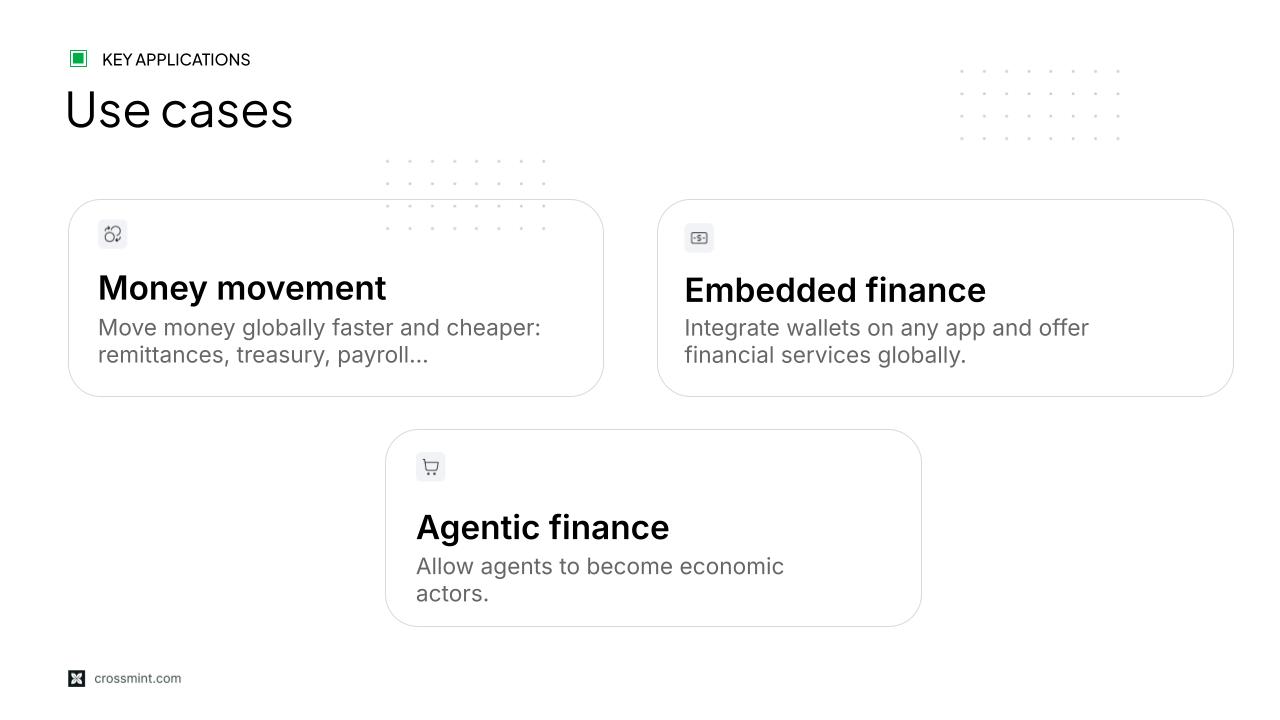

The primary patterns emerging across fintechs fall into three categories: cross-border money movement (remittances, payroll, treasury), embedded finance (neobank-style apps offering wallets, cards, yield, and trading), and agentic payments, where AI agents transact autonomously on stablecoin rails.

MoneyGram went from contract signing to live stablecoin production in just over two months. The Marshall Islands leapfrogged an entire legacy banking system, delivering universal basic income digitally to citizens scattered across thousands of islands. These aren't pilots. They're live, scaled products.

The Architecture Decisions That Can Make or Break You

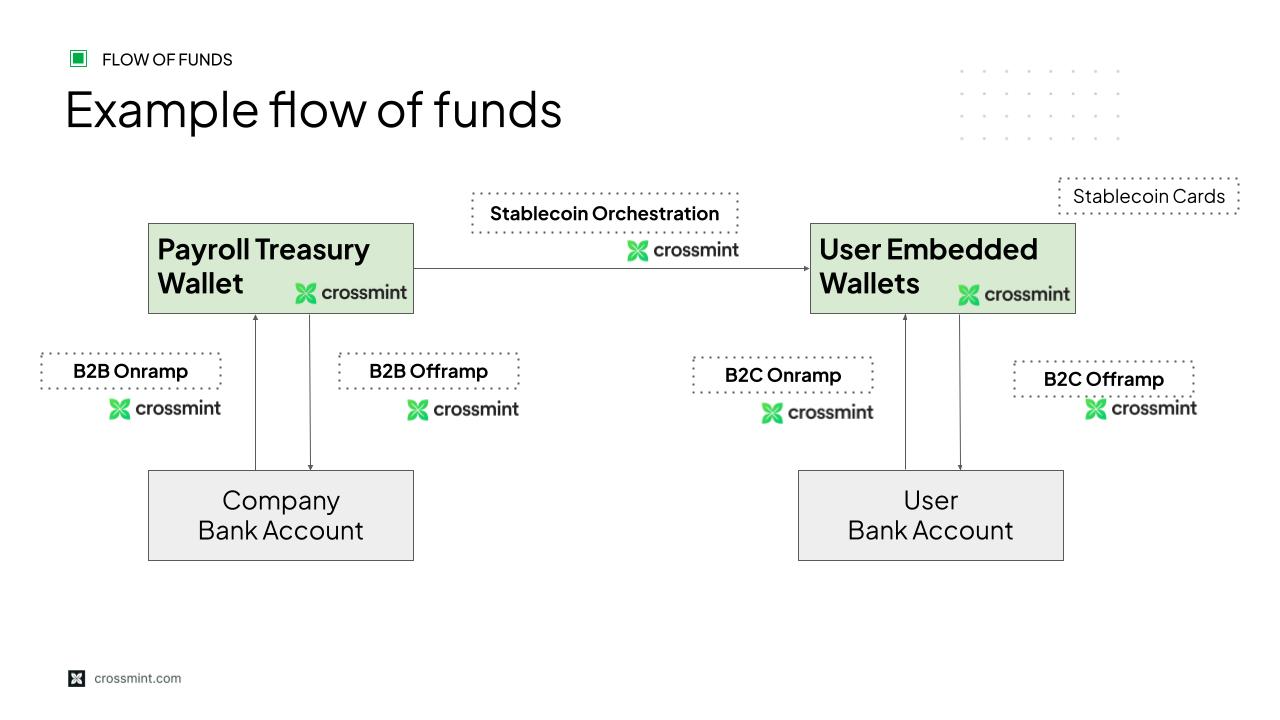

Before writing a line of code, you need to map out how money actually moves through your system. Take cross-border payments: you're really looking at two domestic transactions connected by a stablecoin transfer. A sender converts fiat to stablecoins locally, those stablecoins move instantly to the recipient, and the recipient either holds them or converts back to local currency. This is the "stablecoin sandwich" pattern, and whether it's closed (both sides in fiat, stablecoins invisible in the middle) or open (recipient keeps stablecoins) determines your wallet design, compliance requirements, and product roadmap.

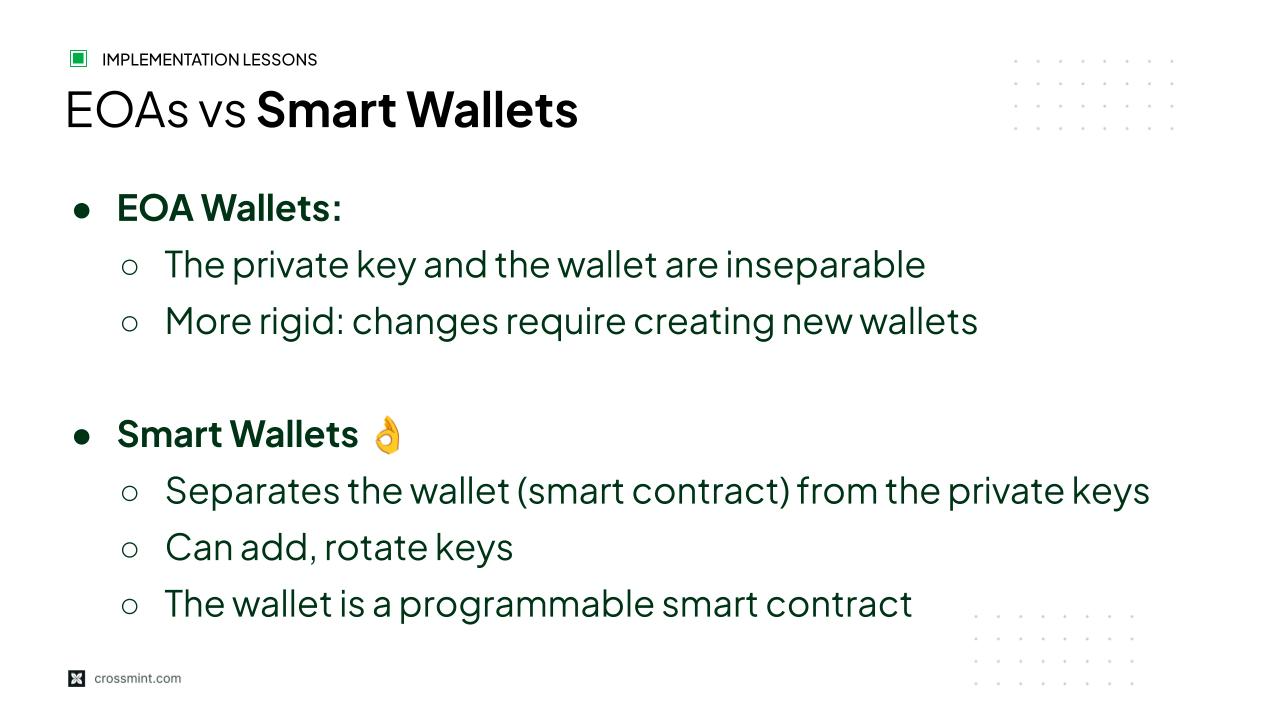

On the wallet side, three architectural choices every fintech needs to get right early: segregated vs. omnibus wallets, custodial vs. non-custodial, and EOA vs. smart wallets.

tl;dr segregated accounts are almost always better. Non-custodial gives you global coverage without jurisdiction-by-jurisdiction licensing. And smart wallets, which decouple the wallet from key management, future-proof your infrastructure against regulatory changes, quantum computing risks, and vendor lock-in. Today, the UX gap between custodial and non-custodial has effectively disappeared. No seed phrases, no gas fees, full account recovery.

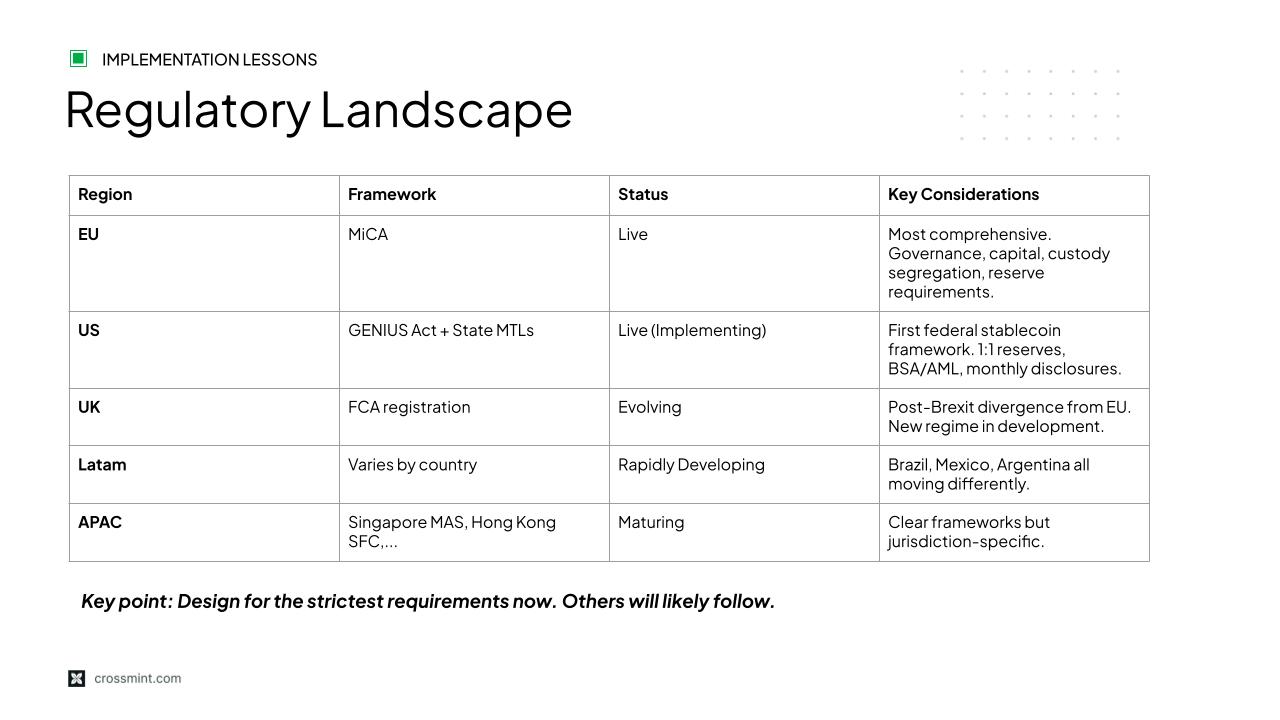

Compliance First, Not Last

If you're touching funds, fiat or crypto, you're likely engaged in regulated activity. Too many companies learn this the hard way. The right approach: bring legal in during design, not after launch. MiCA is live in Europe. The US GENIUS Act and state MTLs are evolving. Dozens of countries are building their own frameworks. The compliance surface area is only growing, and retrofitting is far more expensive than building it in from the start.

Don't Overengineer the Launch

The companies that go live in days focus on core flows first. The ones that take six-plus months are chasing features that don't matter yet. Ship something simple, get traction, then optimize. And don't launch your own stablecoin unless you're operating at a scale where third-party ecosystem adoption is realistic. For most companies, using an existing stablecoin like USDC or USDG and negotiating yield-sharing terms is the faster, smarter path.

All-in-One vs. Point Solutions

A typical stablecoin implementation requires wallets, on/offramps, orchestration, KYC/AML, and compliance infrastructure. Most companies start by stitching together five or more vendors, which creates integration overhead, inconsistent APIs, and a compliance surface area that multiplies with every new provider. Consolidating on a single platform means faster launches, fewer regulatory gaps, and one unified API instead of context-switching between vendor docs. MoneyGram consolidated their entire stablecoin stack into one integration and went live in two months. That timeline isn't realistic when you're coordinating across half a dozen vendors.

Go Deeper

This is a condensed version of a longer presentation that covers detailed flow-of-funds breakdowns, example case studies, compliance considerations, agentic payment infrastructure, and predictions for what's about to go live across the industry this year.

Watch the full webinar on-demand →

Ready to start building? Talk to our team about your stablecoin implementation.