You've seen the wallet demos. Couple lines of code and you've got wallets. What they don’t tell you: there's a massive gap between creating a wallet and building a wallet experience users can actually use.

Is wallet creation really just a few lines of code?

Yes and no. Creating wallets is simple. Every provider has quickstart guides showing wallet creation in minutes. The demo works perfectly.

But a wallet without functionality is just an address. Users need to send funds, check balances, view history. Each "basic" feature opens new complexity.

The guides stop after wallet creation. They don't mention that sending funds requires transaction construction, gas estimation, nonce management, and chain-specific quirks. They don't explain that balance checks need separate data providers.

What happens after users create wallets?

Reality hits fast. Users want to check balances. Wallet providers don't include data APIs which means another integration and extra code.

Users want to send funds. A simple transfer requires:

- Constructing transactions

- Estimating gas fees

- Managing nonces

- Broadcasting to network

- Handling failures

- Showing meaningful errors

Each step differs by chain. Solana transactions look nothing like Ethereum. Code that works on one breaks on another.

A lot of code for something as simple as a transaction. But that’s just the start.

How do I handle gas fees without confusing users?

Users don't understand gas. Asking them to pay fees kills adoption and ruins UX. So you decide to sponsor gas.

Gas sponsorship sounds simple until implementation. Ethereum needs paymasters. Solana needs transaction wrapping. Other chains need different solutions.

Managing sponsorship means maintaining treasury wallets on every chain:

- Monitor balances

- Set up alerts

- Handle top-ups

- Prevent abuse

- Track costs

Complexity multiplies per chain. Different tokens, different fees, different edge cases. You're building multi-chain treasury management when you just wanted to hide fees.

What integrations will I need beyond the wallet SDK?

Feature requests start immediately. Users want to add money. You need fiat onramps. Another vendor, another integration.

Compliance hits next. Transaction screening for AML requirements. Minimum contracts start at tens of thousands yearly.

Users want yield. Now you're integrating staking protocols. Each chain has different options and risks.

Cross-chain functionality becomes essential. Bridge integrations are complex. Different bridges, different routes, frequent failures.

Each feature adds vendors:

- Fiat rails

- Compliance screening

- Yield products

- Cross-chain bridges

- Token swaps

How many vendors will I actually end up managing?

Vendor count explodes. Wallet provider. RPC provider. Data APIs. Gas sponsorship. Compliance. Fiat. Bridges.

Multiple chains make it worse. Your Ethereum RPC might not support Solana. Each chain might need specialized vendors.

Typical implementation:

- 1 wallet provider

- 2-3 RPC providers

- 1-2 data providers

- 1 compliance service

- 1-2 fiat providers

- 1-2 bridge providers

You're managing 10+ vendors. Different APIs, different limits, different errors. More vendor management than product development.

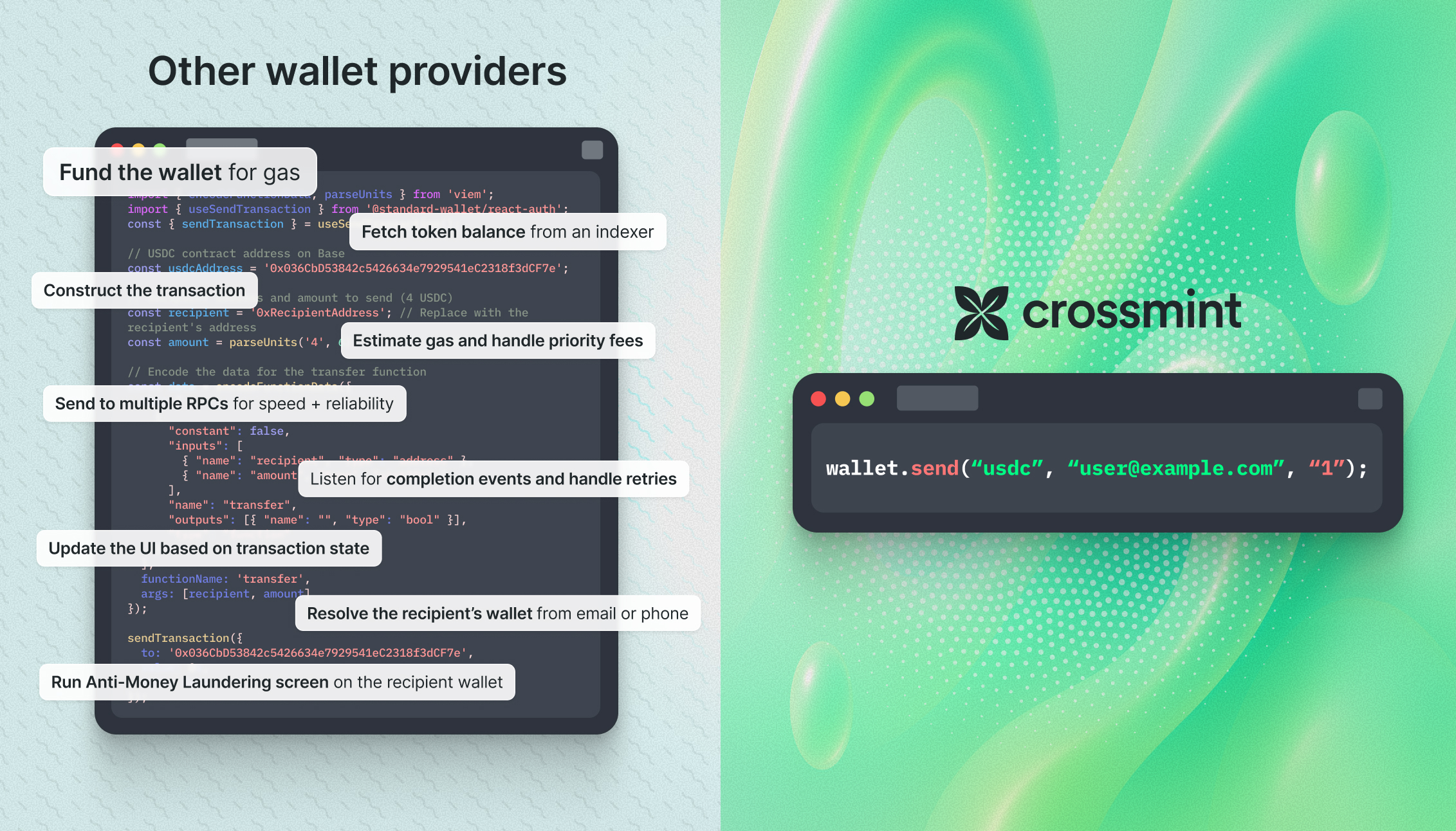

What's the total code complexity I'm signing up for?

Five lines becomes thousands. Each integration adds hundreds of lines. Error handling doubles it. Multi-chain multiplies everything.

Chain abstraction becomes a major engineering feat:

- Different transaction formats

- Different gas mechanisms

- Different confirmation times

- Different error types

Testing becomes nightmarish. Each chain needs test environments. Each vendor needs mocking. Edge cases multiply exponentially.

Maintenance burden grows constantly. APIs change. Chains evolve. Security patches need immediate deployment.

What should I look for in a complete wallet solution?

The ideal wallet infrastructure solves these problems holistically.

- Native gas sponsorship should work across all chains without custom code. Toggle on, forget treasury management. Provider handles gas, bills you fiat.

- Compliance tools built-in. Transaction screening without separate contracts. Configuration option across chains.

- Financial features native to platform. Onramps, swaps, yields in one integration. Chain-agnostic APIs.

- Smart wallet architecture provides flexibility. Unlike fixed private keys, smart wallets allow signer rotation and migration without changing addresses.

- Everything from one vendor with unified APIs. Manage one provider instead of ten. Write dozens of lines instead of thousands.

The difference between wallet creation and complete wallet experience is massive. Choose infrastructure that scales with you, not just your demo.

Get started with Crossmint

Build with the most powerful wallet SDK for fintechs, enterprises and AI agents today.