MoneyGram serves 50 million people across 200 countries and territories, moving billions of dollars annually. Yet international transfers are still weighed down by high costs and inefficiencies, with many underbanked recipients forced to collect cash in unstable currencies.

By integrating Crossmint’s wallet and stablecoin orchestration infrastructure, MoneyGram is creating a new remittance experience — one where users can receive, save, spend, and earn rewards with US dollar stablecoins.

How It Works

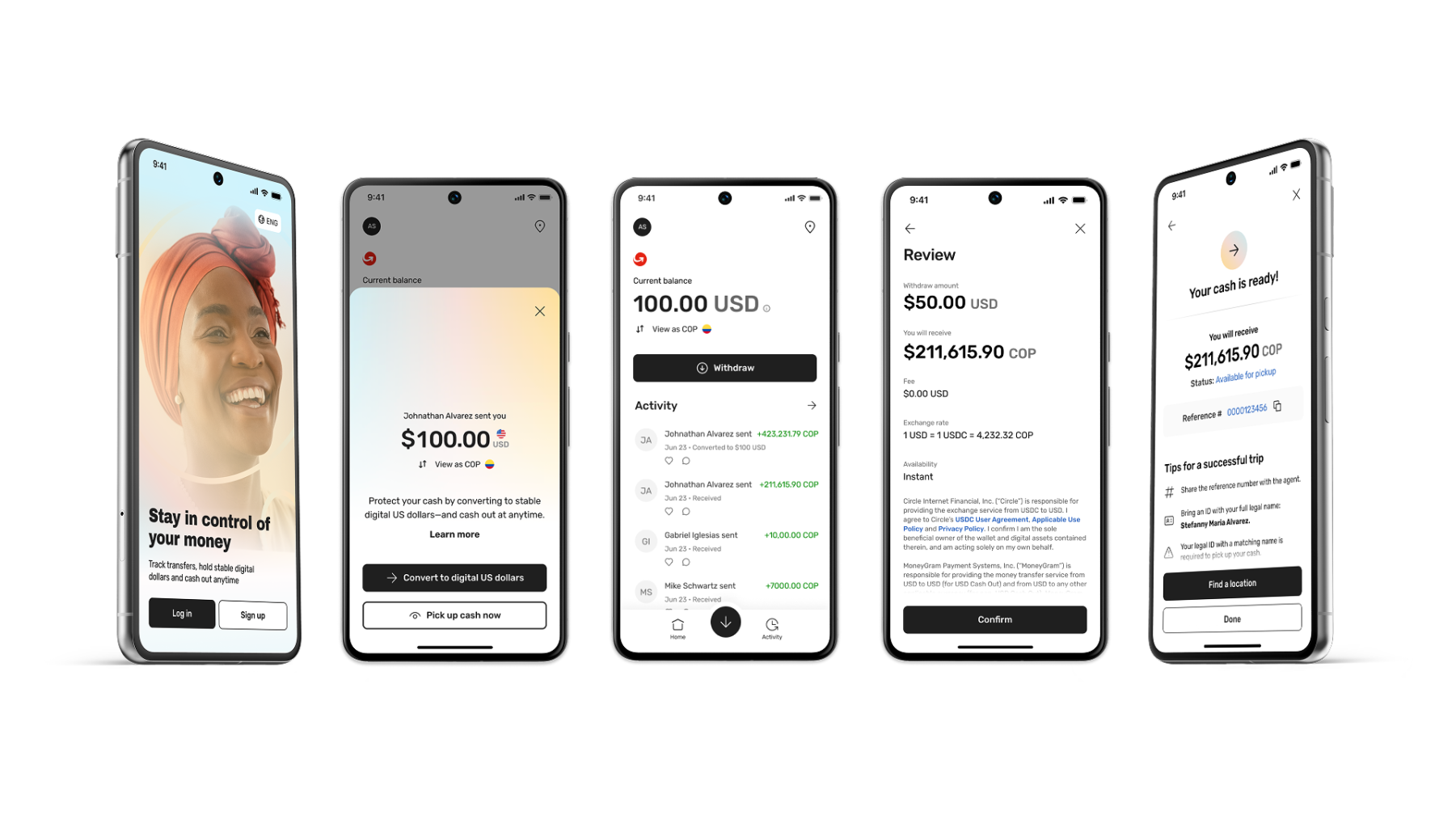

Send: Senders initiate a transfer through the MoneyGram app or at a physical location, just like any typical remittance.

Receive: Instead of waiting in line for local cash, the recipient now receives USDC instantly in a Crossmint wallet embedded in the MoneyGram app.

Access: Recipients can:

- Save in USD, protected from local currency devaluation.

- Cash out to local currency only when needed.

- Access additional financial services.

Under the Hood

Behind the scenes, Crossmint powers all the blockchain infrastructure for these flows, using USDC on the Stellar Network:

- Stablecoin orchestration: MoneyGram mints USDC and pre-funds a Crossmint-powered custodial treasury wallet.

- Money movement: When a user sends money, MoneyGram calls Crossmint’s API to transfer funds from the treasury wallet to the recipient’s wallet, accessible via the MoneyGram app.

- MoneyGram app: recipients can sign up or log in with just an email and instantly access their funds. The app features a white-label, embedded non-custodial wallet with the simplicity of a traditional fintech app—abstracting away all blockchain complexity. Users can check balances, transfer funds, view transaction history, and access additional services, all powered by Crossmint’s APIs.

Going live in just over two months

Thanks to Crossmint, MoneyGram went from contract signing to live production in just over two months. This was possible because:

- No blockchain engineers needed. Crossmint’s infrastructure is delivered through easy-to-use chain-agnostic APIs that abstract away blockchain complexity while still allowing low-level control.

- Single vendor: Crossmint consolidated the entire stack into one provider, eliminating the need to manage multiple partners.

- Hands-on support: Dedicated product and engineering resources worked side by side with the MoneyGram team to accelerate launch.

The Bigger Picture

MoneyGram’s new platform shows how stablecoins can transform cross-border payments — reducing costs, improving speed, and unlocking access for millions of underbanked users.

But the same foundation goes far beyond remittances. With Crossmint’s wallet and stablecoin infrastructure, any fintech can:

- Embed stablecoin accounts into their apps with just a few lines of code.

- Reduce costs and expand reach by moving money instantly across 50+ blockchains.

- Layer on financial products like payments, rewards, savings, trading, or credit — without needing deep blockchain expertise.

- Stay compliant with a hybrid custodial/non-custodial design ready for global regulation.

Crossmint abstracts away all of the blockchain complexity, so fintechs can focus on building great products and scaling faster.

Conclusion

Stablecoins are opening the door to a new era of fintech, where anyone can launch global products in weeks instead of years.

MoneyGram is already proving what’s possible. By using stablecoins as core infrastructure, they’ve cut costs, expanded their reach, and created entirely new revenue streams.

Crossmint made it simple for them to get there faster — and we can do the same for you.

Whether you’re a fast-growing startup or a global enterprise, we’d love to help you launch sooner and scale with confidence.

👉 Get in touch with us here