The Republic of the Marshall Islands (RMI) is modernizing how funds move across its economy by introducing blockchain-based wallets for citizens.

At the center of this effort is ENRA, the country’s nationwide Universal Basic Income (UBI) program delivered onchain, the first of its kind. ENRA provides quarterly support to eligible Marshallese citizens, including many who live in remote atolls with limited access to traditional banking.

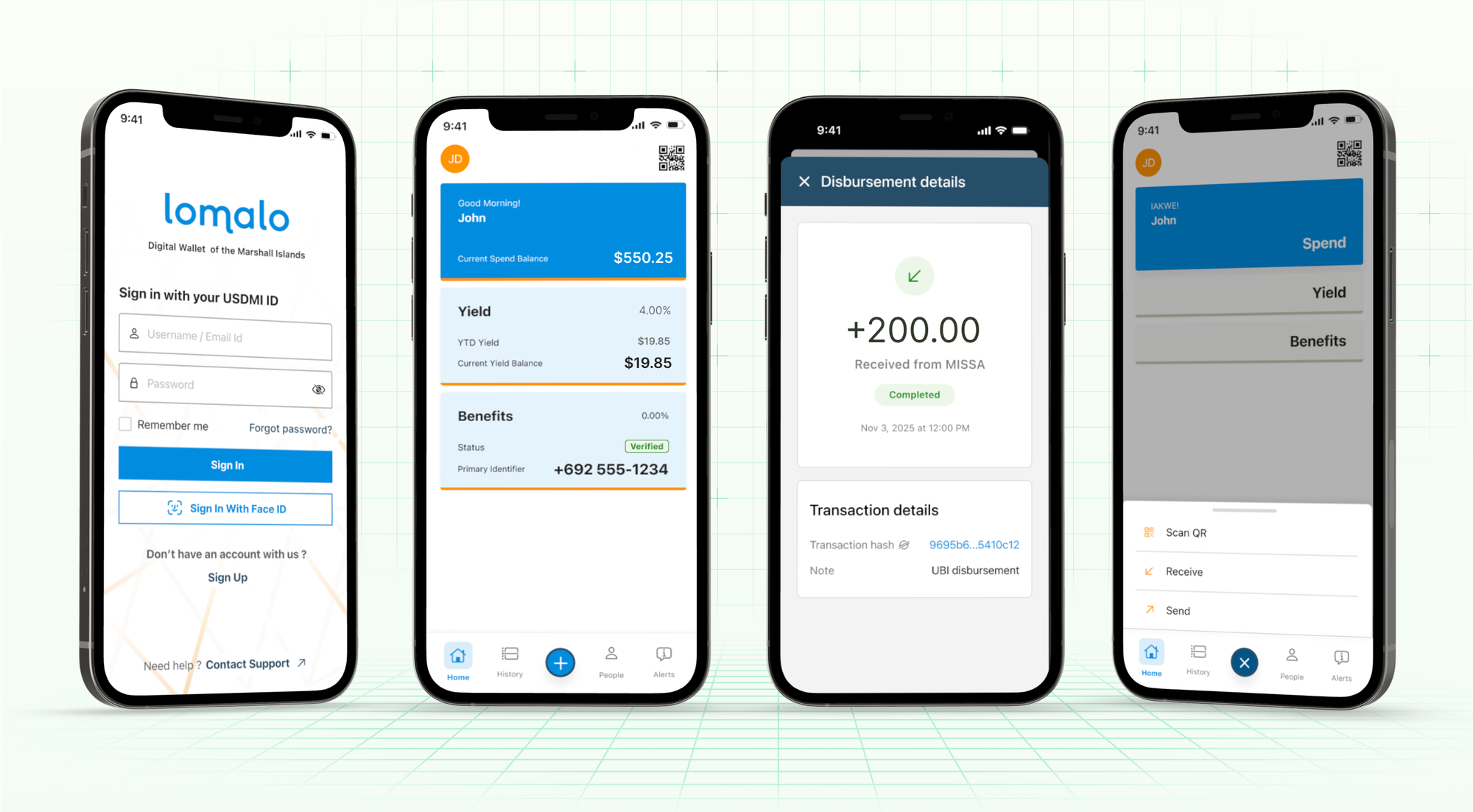

To make nationwide delivery possible, the RMI built Lomalo, an app powered by Crossmint wallets. Lomalo enables residents to receive, store, and use U.S. dollar–denominated tokens directly from their phones, including for citizens without a bank account. Beyond receiving benefits, citizens can transfer funds peer-to-peer to other Marshallese.

ENRA’s financial foundation is USDM1, a USD-denominated digital sovereign bond issued by the Marshall Islands and backed 1:1 by short-dated U.S. Treasuries. USDM1 is issued on the Stellar network, enabling fast, low-cost transfers that make digital disbursements viable across vast geographic distances.

Together, Lomalo and Crossmint wallets are laying the groundwork for a more connected Marshallese economy.

The Challenge

When “going to the bank” is a logistical event

The Marshall Islands operates entirely on the U.S. dollar. The country spans roughly 1,200 islands across nearly two million square kilometers of ocean. In many outer atolls, banking infrastructure is limited or absent. For some citizens, reaching a banking center can mean traveling long distances by plane, managing complex transport logistics, and facing weather delays that are a part of life in the Western Pacific. When disbursements arrive late, it directly affects access to everyday essentials like food, fuel, school supplies, and healthcare.

Physical U.S. dollars are a bottleneck. Currency shipments arrive quarterly, typically by boat in a shipping container, or sometimes by airplane escorted by armed guards. Banks respond with withdrawal limits, and even when citizens stay within those limits, ATMs and branches can run out of physical currency. Restocking schedules are unpredictable, especially as you get further from bank locations.

Over time, chronic physical currency constraints have pushed communities toward IOUs and informal exchange, increasing friction for households, merchants, and small businesses.

To make the UBI program viable nationwide, the RMI needed a system that was:

- Fast, so funds are usable when needed

- Reliable, so access is not dependent on a single physical distribution bottleneck

- Accessible, working for banked and unbanked citizens

- Easy to use, with minimal learning curve

- Resilient, functioning over low-bandwidth and satellite connectivity

- Secure and auditable, meeting government-level oversight requirements

Traditional rails haven’t been able to meet all of these requirements simultaneously at national scale.

The Solution

A digital system for benefits, transfers, and everyday economic activity

To ensure that funds can reach every eligible citizen, the Marshall Islands launched Lomalo, a mobile app designed for receiving and managing benefits, built on Crossmint’s wallet infrastructure.

With Lomalo and Crossmint wallets, citizens can:

- Receive benefits digitally in a wallet tied to their identity

- Store value safely without seed phrases or crypto complexity

- Transfer funds peer-to-peer to other Marshallese

- Move or use funds from their phone

- Access balances quickly, even in low-bandwidth conditions

- Recover accounts easily, designed for mainstream usability

Crossmint handles the complex wallet logic and security behind the scenes, allowing Lomalo to focus on a clean, citizen-friendly experience.

Disbursements are being delivered through the Stellar Disbursement Platform, depositing USDM1 directly into eligible recipients’ Lomalo wallets.

USDM1: the financial backbone behind ENRA

Underpinning ENRA is USDM1, a USD-denominated digital sovereign bond issued by the Marshall Islands and backed 1:1 by short-dated U.S. Treasuries held with an independent U.S. trust company under a New York law structure.

USDM1 is recorded and transferred onchain to make distributions fast and low-cost, while custody, redemption, and oversight remain grounded in traditional legal and supervisory frameworks. USDM1 can be redeemed 1:1 for U.S. dollars through established redemption channels.

The Treasury interest is shared between citizens and their government helping deliver benefits while ensuring the program’s long-term sustainability.

For citizens, USDM1 balances appear in Lomalo like a simple digital account.

Why Crossmint

Wallets designed for mainstream UX, rapid rollout, and regulated environments

Crossmint was chosen because the program needed a wallet experience that feels familiar to everyday users—onboarding via standard login methods (email or phone number), no seed phrases to manage, and straightforward account recovery. The infrastructure is built for regulated programs and designed to scale to national-level distribution, including in low-bandwidth or satellite-connected environments.

Developer-friendly APIs also meant Lomalo could ship quickly without building a large, specialized blockchain engineering team in-house. By using Crossmint’s wallet infrastructure, Lomalo can prioritize usability for citizens while Crossmint handles core wallet security, account recovery, and blockchain complexity under the hood.

“For families in remote communities who previously waited weeks for paper checks or physical currency shipments, this changes everything. With Lomalo and USDM1, citizens can now receive disbursements in seconds. It’s a blueprint for how organizations can modernize financial infrastructure to reach everyone, no matter where they live.”

— Rodri Fernández Touza, Co-founder, Crossmint

A New Standard for Digital Benefits and Local Commerce

Together, this system is designed to make fund distribution easier to access, more predictable, less dependent on physical currency logistics, and better suited for remote communities.

As digital wallets grow in use, the same rails can support more of the Marshallese economy moving to digital transfers and away from IOUs and informal exchange.

For governments and organizations globally, the Marshall Islands offers a working model for modernizing disbursements and financial access using a sovereign-backed instrument and a mainstream wallet experience.

Build With Crossmint

Crossmint makes it easy to embed wallets and financial services anywhere using simple APIs and dashboards. If you're exploring digital benefits, transfers, disbursements, tokenization, or onchain user experiences, our team can help.

Read the full USDM1 white paper here.