Introduction

As AI agent usage increases, AI agent companies that stay up-to-date and adapt to new and emerging pricing models and monetization strategies will be able to increase their bottom line and stay competitive in the growing agentic landscape. There are four AI agent pricing models that are most popular among companies, but as AI agents become the go-to interface for search and discovery, AI agent companies have an opportunity to unlock new revenue streams by becoming marketplaces where users buy & sell goods and services directly through agents.

In this guide, we’ll dive into the popular AI agent pricing models today and look at new monetization strategies emerging around agentic commerce.

The Four Core AI Agent Pricing Models

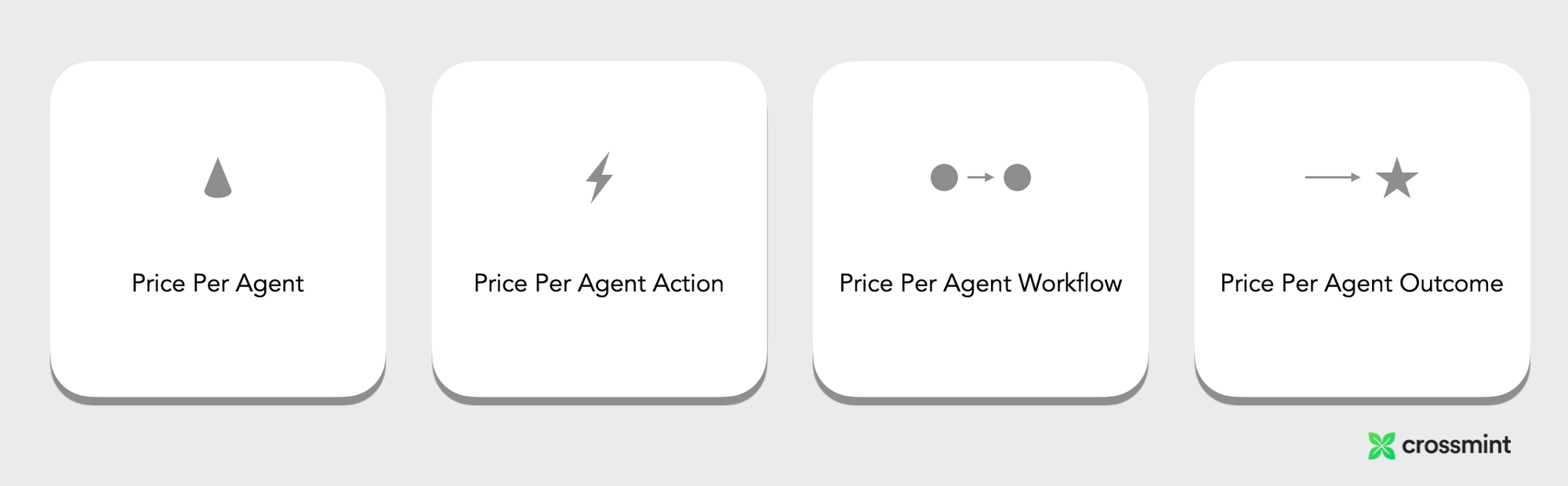

The four most popular AI Agent pricing models today are:

- Price Per Agent

- Price Per Agent Action

- Price Per Agent Workflow

- Price Per Agent Outcome

Price Per Agent (FTE Replacement Model)

This model positions AI agents as digital employees with a fixed monthly fee per agent. Companies like Harvey, 11x, and Vivun have pioneered this approach, effectively positioning their AI agents as digital employees. It works best when your agent handles comprehensive job functions with predictable workloads, allowing you to tap into headcount budgets that are typically much larger than tech tool budgets. While straightforward to implement, this model faces increasing competitive pressure as technology costs decline.

Price Per Agent Action (Consumption Model)

Similar to cloud infrastructure pricing, this model charges customers each time an agent performs a discrete action. Companies like Bland, Parloa, and HappyRobot implement this approach for varied tasks with unpredictable volumes. While providing transparency and usage-based alignment, this model offers the lowest competitive differentiation, essentially making you a commodity where prices only go down.

Price Per Agent Workflow (Process Automation Model)

This model charges for complete sequences of agent actions that deliver specific outcomes. Companies like Rox, Salesforce, and Artisan have adopted this approach for complex but standardized processes. This model strikes a balance between consumption and outcome-based pricing, but complex workflows can be challenging to price effectively.

Price Per Agent Outcome (Results-Based Model)

The outcomes model ties pricing directly to completed objectives, with companies like Zendesk, Intercom, and Chargeflow charging only when tangible results are delivered. This model creates the clearest value proposition for customers, as they only pay when they receive tangible results. Industry experts believe this model will ultimately dominate the market as it creates the strongest alignment between provider and customer success.

Agentic Commerce Unlocks New Revenue For AI Agent Companies

Understanding Agentic Commerce

Agentic commerce represents the next evolution in AI monetization - using AI agents as economic actors that can buy and sell on users' behalf. As these agents increasingly become the primary interface for research and discovery, the traditional funnel between discovery and purchase is collapsing. This shift is creating entirely new consumer behaviors. Users are increasingly comfortable delegating purchasing decisions to their trusted AI agents, fundamentally changing how people discover and shop for products. This transformation directly challenges traditional e-commerce platforms and search engines that monetize the discovery phase.

Monetization Strategies in Agentic Commerce

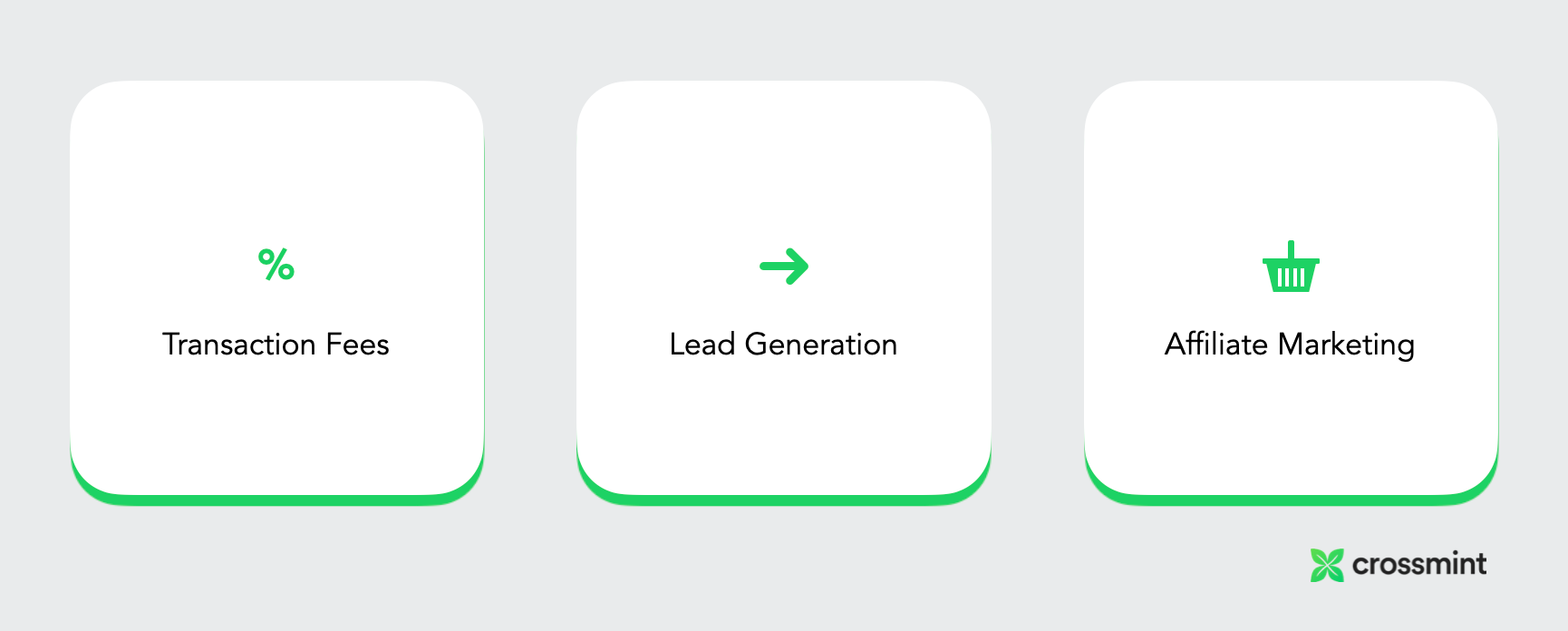

Three monetization models that are emerging for AI agent companies adopting agentic commerce are transaction fees, lead generation and affiliate marketing.

Transaction Fee Model: Companies can capture a percentage of transactions facilitated by their agents, similar to e-commerce marketplace models. This approach requires minimal changes to existing business models but necessitates high transaction volumes to generate meaningful revenue. The challenge lies in setting fees that balance profitability with competitive positioning.

Lead Generation Model: AI agents can qualify and monetize leads delivered to merchants. This model requires sophisticated attribution systems to track which agents influence purchasing decisions.

Affiliate Revenue Model: Commission-based structures allow agent developers to earn a percentage of sales they facilitate through partner networks. This model aligns incentives across the ecosystem but requires careful balance between recommending the best products for users versus the most profitable ones for the provider.

Enabling Agentic Commerce Infrastructure for AI Agent Companies

Crossmint's Agentic Finance Platform enables AI agent companies to unlock new revenue streams by providing the tools to monetize economic activity like buying and selling goods and services within their AI agents:

World Store: An API service giving agents access to over 1 billion SKUs of real-world goods and services, with support for payments using major tokens across 40+ chains.

AI Agent Wallets: Non-custodial wallets with programmable guardrails that enable agents to manage assets securely, maintain accountability through public transaction records, and operate within configured spending limits.

GOAT SDK: An open-source library offering 250+ onchain actions across 40+ blockchains, allowing agents to send stablecoins, swap tokens, and create DeFi positions with MIT license and support for major frameworks.

Credentials: Tools to authorize agents to act on users' behalf securely.

If you’re an AI agent company and want to learn more, reach out to us here!