Remittance companies, payroll platforms, neobanks, embedded finance businesses and traditional banks using stablecoins to move money across borders need one critical piece of infrastructure: wallets. These wallets are quickly becoming the backbone of modern financial systems—giving users full control of their funds while reducing the risks and liabilities of centralized custody.

Additionally, non-custodial wallets can now unlock new markets and accelerate customer growth. Why? The user experience around non-custodial wallets has greatly improved where small start ups to big institutions can embed non-custodial and custodial wallets that feel native and user friendly. The ability to mix and match non-custodial and custodial wallets in hybrid set ups also enables companies to strategically expand into new geographies.

In this article, we’ll break down what non-custodial wallets are, their key benefits, how hybrid wallet custody set ups can be a competitive edge and the compliance considerations fintechs must navigate when enabling cross-border payments.

What are non-custodial wallets?

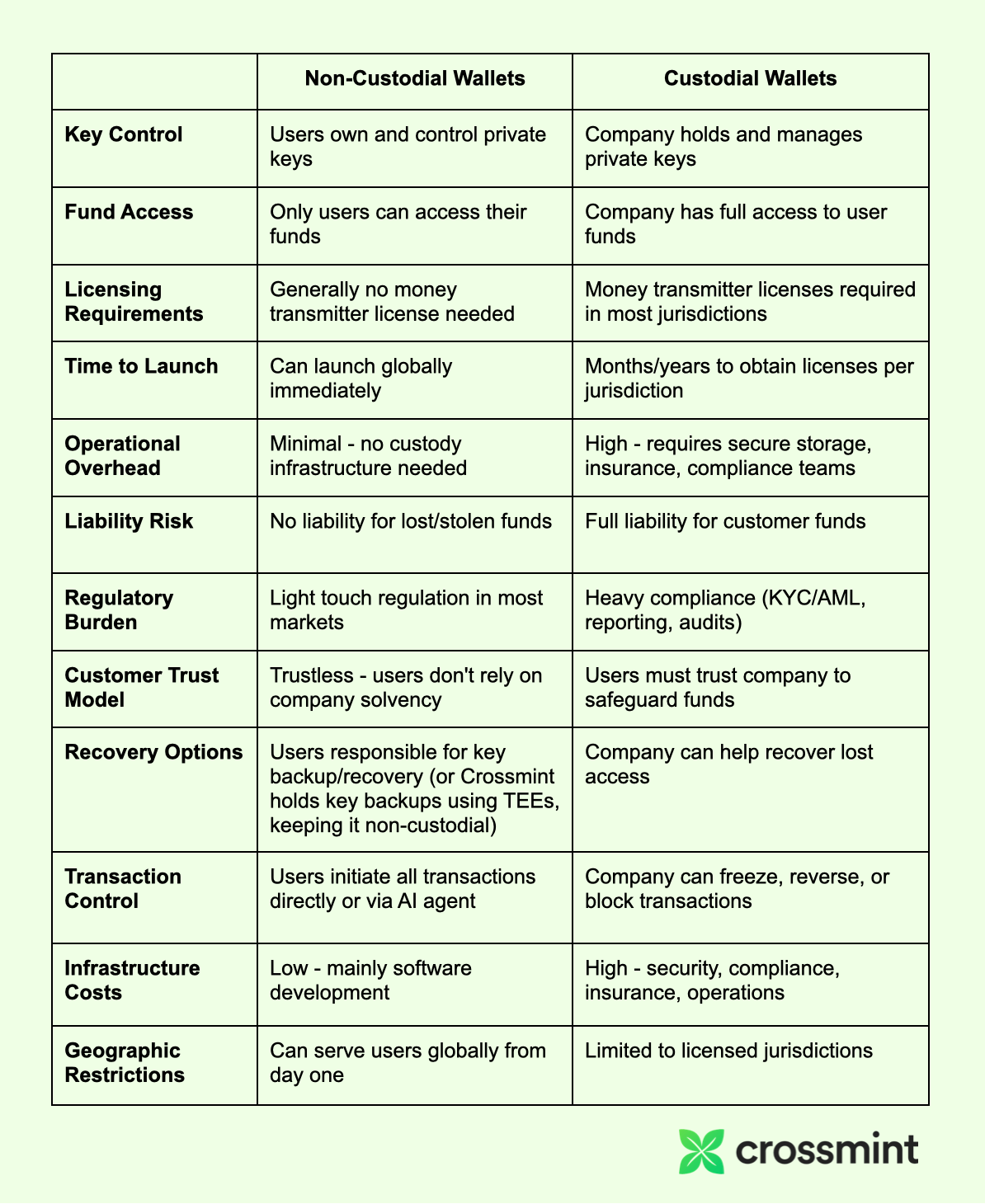

Non-custodial wallets are accounts that can hold stablecoin and digital asset balances where your customers hold their own cryptographic keys - essentially the "passwords" that control the money. Think of it like this: with traditional banking, you hold customers' money in your vaults. With non-custodial wallets, customers keep their money in their own personal vaults that only they can control so you (the wallet provider) isn’t in the flow of funds and can bypass certain regulatory requirements.

Learn how to create a Fintech App in minutes - complete with smart non-custodial wallets, stablecoin on/off-ramps, yield, cards, and built-in RPCs, data APIs, and sanction screening.

Historically, non-custodial wallets have been associated with a more complex user experience—think seed phrases, manual transaction approvals, and blockchain fees. Today, non-custodial wallets can be designed to feel just as seamless as custodial wallets. Features like social logins, biometric authentication (such as FaceID or fingerprint), and gasless transactions (where blockchain fees are handled behind the scenes) make onboarding and daily use simple and intuitive.

Users can sign up and transact without ever seeing a seed phrase or being prompted to approve every transaction, making the blockchain invisible to the end user. This approach combines the security and autonomy of non-custodial wallets with the ease of use typically found in fintech apps.

Key Advantages of Non-Custodial Wallets for Cross-Border Payments Companies

Speed to Market & Global Reach

- Non-custodial wallets can launch globally from day 1 without licensing burden

- Custodial wallets (fiat or crypto) require obtaining licenses, which significantly slows down go-to-market

- Better serves unbanked populations who may face barriers with traditional custodial accounts

Reduced Operational & Regulatory Burden

- Custodial solutions come with very heavy operational costs and infrastructure requirements

- Non-custodial approach avoids the extensive compliance, security, and operational overhead of holding customer funds

- May fall under different regulatory frameworks than traditional money transmitters

- Reduced KYC/AML requirements in some jurisdictions (though this varies by country)

- No need for complex custody infrastructure or cold storage management

- Faster settlement times as transactions happen directly between users

- Lower infrastructure costs and reduced staffing needs for compliance and security teams

Lower Risk & Liability

- Custodial wallets create significant liability for companies holding customer funds

- Non-custodial model eliminates this liability since companies never control user assets

- Companies don't hold customer funds directly, eliminating the risk of large-scale hacks or internal theft

- Lower insurance and compliance costs compared to custodial solutions

User Control & Transparency

- Users maintain full control of their private keys and funds

- Onchain transactions that users can independently verify

- No need to manage complex reconciliation of custodial accounts

- Reduced customer support burden for account access issues

The Hybrid Custody Approach: Best of Both Worlds

Companies don't need to choose exclusively between custodial and non-custodial solutions. A hybrid approach allows financial service providers to mix and match both wallet types for optimal geographic coverage and strategic flexibility. This strategy enables companies to launch globally with non-custodial wallets while simultaneously building custodial infrastructure in key markets where they have or plan to obtain licenses.

The hybrid model offers several strategic advantages:

- Leverage existing licenses where available while expanding reach through non-custodial options in new territories

- Offer customers choice based on their preferences and local regulatory requirements

- Start non-custodial in new markets and transition to custodial where it makes business sense

- Maintain full geographic coverage without waiting for licenses in every jurisdiction

This approach also serves as a risk mitigation strategy. Companies can test new markets with non-custodial wallets before investing in expensive licensing processes. If a market proves viable, they can then pursue custodial licenses to offer additional services. This creates a "crawl, walk, run" expansion strategy that balances speed to market with long-term regulatory compliance.

Ready to unlock global payments with less risk and faster go-to-market?

With Crossmint’s wallet infrastructure and all-in-one stablecoin platform, you can offer your customers seamless, instant, and secure global transactions—while maintaining full control and flexibility over your payment infrastructure.

Our solution is designed for the needs of modern fintechs and payment providers:

- Flexible Custody: Choose the custody model that fits your business and regulatory needs—fully custodial, non-custodial, or a hybrid approach. Effortlessly update models as your requirements evolve, without disrupting your users.

- No Vendor Lock-In: Future-proof your business with true portability. Our architecture ensures you can migrate providers or bring wallet management in-house at any time, with minimal user disruption and no need to change wallet addresses or export private keys.

- Programmable Controls: Set custom policies, transaction limits, and approval flows to match your compliance and operational requirements.

- Frictionless User Experience: Onboard users with social logins, passkeys, or biometrics—no seed phrases or complicated steps required.

Book a demo and connect with our team today to see how easy it is to get started.