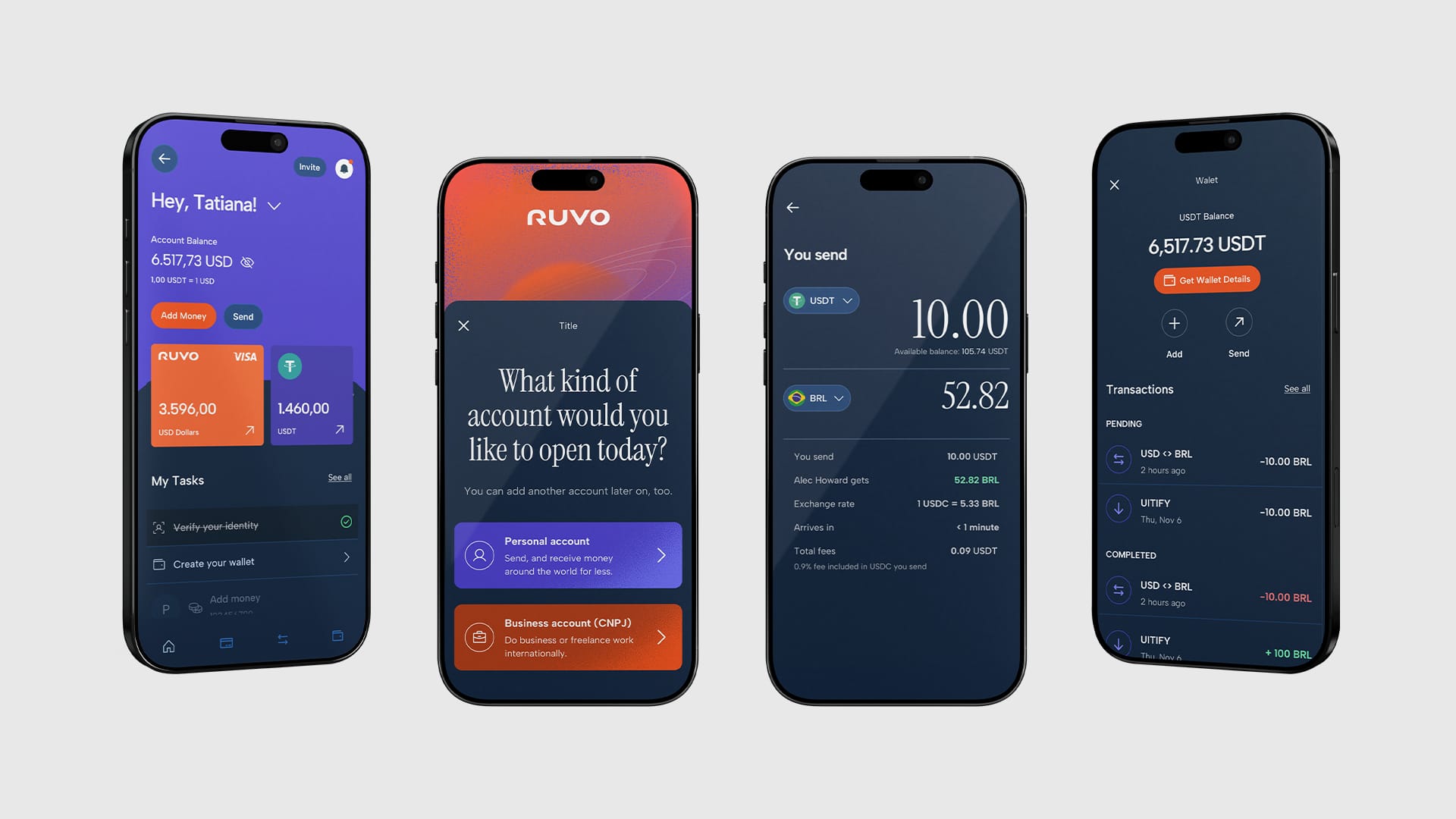

Ruvo is a global dollar account built for users who move money to and from the United States and Brazil. By connecting Pix, stablecoins, ACH/wire, and Visa into a single mobile wallet, Ruvo makes it easy to earn, send, convert, spend, and save dollars, all while avoiding slow banks and hidden FX fees.

With Ruvo, Brazilians and U.S citizens can:

- Receive USD from abroad

- Convert between BRL and USDT instantly

- Send money from Brazil to the U.S.

- Spend worldwide with a Visa card

- Save in digital dollars and earn yield

The Challenge: Making Cross-Border Payments Accessible and Affordable for Brazilians

Moving money between Brazil and the United States means navigating disconnected financial systems. Pix enables instant local payments in Brazil but doesn’t support cross-border transfers. International wires are slow and expensive. Cards allow global spending but often force immediate FX conversion with limited transparency.

For Brazilians who earn or spend in dollars, this creates fragmented experiences, delayed settlement, and unnecessary currency conversion.

Ruvo is built for Brazilians who earn or spend in dollars.

Users can receive USD from:

- International employers

- Freelance platforms

- Clients and businesses abroad

They can also send money from Brazil to the U.S. for:

- Living expenses

- Family support

- Travel

- Investments or savings

- High school and University Tuition

Instead of forcing immediate conversion, Ruvo lets users hold dollars, choose when to convert to BRL, or spend directly in USD.

Traditional banking separates local payments, cross-border transfers, and card spending into different systems. Ruvo brings them together:

- Pix for instant funding and withdrawals in Brazil

- Crypto rails for fast, low-cost dollar transfers between Brazil and the U.S.

- Visa for global spending in USD, online or in person

This combination allows Ruvo to support two-way cross-border payments and crypto native transfers:

- Brazil → U.S.

- U.S. → Brazil

- Crypto ↔ crypto transfers between wallets

All while keeping pricing transparent and settlement fast, regardless of whether users are moving dollars, reais, or digital assets.

To deliver this experience at scale, Ruvo needed a modern EVM wallet infrastructure that could support secure, scalable stablecoin transactions while remaining simple and familiar for end users.

The Solution: Delivering a secure, scalable, and user-friendly wallet infrastructure with Crossmint

Ruvo partnered with Crossmint to power their multi-rail payment infrastructure, leveraging Crossmint's enterprise-grade smart wallet APIs to build their dollar account platform.

Beyond payments, Ruvo helps Brazilians grow and preserve their wealth in dollars.

Users can save in digital dollars and access yield opportunities, giving them tools traditionally reserved for institutions, but inside a Brazilian-friendly app.

With Crossmint's wallet infrastructure, Ruvo can:

- Deploy programmable smart wallets that seamlessly connect Pix, stablecoins, and Visa, enabling users to move between local and global rails without friction

- Process instant cross-border transfers using USDT and other stablecoins, settling in minutes instead of days

- Abstract away crypto complexity so users experience a simple dollar account, while Crossmint handles key management, gas fees, and blockchain interactions

- Scale securely with SOC 2 Type II certified infrastructure built for fintech and enterprise clients

- Access multi-chain flexibility to optimize for speed, cost, and regional preferences

Built for Brazil, Designed for Global Money

Ruvo was founded by Alec Howard and Mike Mason and is one of the few Latin American startups backed by Y Combinator in recent years.

By building directly for the Brazil–U.S. corridor and operating close to its users, Ruvo focuses on a simple but powerful idea:

“Brazilians and Americans should be able to move money between Brazil and the U.S. as easily as sending a Pix — and grow their wealth with financial tools that work globally," says Alec Howard, CEO of Ruvo. "That’s the standard we’re building toward. Using Crossmint, we were able to deliver a secure, scalable, and user-friendly experience.”

Ruvo is built for Brazilians moving dollars between Brazil and the United States - whether they’re earning USD from abroad or sending money to the U.S. for everyday expenses, family support, travel, investments, savings, or high school and university tuition.

Users can hold dollars, convert to BRL when they choose, or spend directly in USD, all from one app designed for cross-border life.

Build With Crossmint

Crossmint makes it easy to embed wallets and financial services anywhere using simple APIs and dashboards. If you're exploring offering cross-border transfers, payments, or other neobanking services, Crossmint can help.