It’s undeniable that stablecoin adoption is reaching escape velocity as the total supply grows to more than $200 billion in March 2025 and incumbent financial institutions like Paypal and Stripe are launching stablecoins, implementing them within their platforms and acquiring stablecoin infrastructure businesses.

Stablecoins offer key advantages over traditional payment systems that are used today by fintech companies. Settlements happen in seconds to minutes, programmability, lower cost, accessible by anyone in the world with a phone and internet connection, stability compared to other local currencies and running 24/7/365 make stablecoins a powerful medium of exchange for payments around the world.

For businesses looking to implement stablecoins, there are many important questions you need to consider in order to choose the right stablecoin onramp partner:

- Do we need a fully managed solution or an orchestration and issuance provider?

- Which payment methods do we need to accept?

- Which geographies do we need coverage in?

- Which blockchains and tokens do we need coverage in?

- Are the transaction approval rates and settlement times up to our standards?

- Does this partner offer other necessary stablecoin tools like wallets?

In this guide, you will learn about stablecoin onramps and the different stablecoin onramp offerings so that you can make the right decision when choosing a stablecoin infrastructure partner for your fintech app, product or service.

What are Stablecoin Onramps?

To adopt stablecoins within your product, app or service, you will need a stablecoin onramp. A stablecoin onramp is a secure financial gateway that allows customers to convert traditional currency (fiat) into stablecoins. These onramps typically offer various payment methods including credit/debit cards, bank transfers and more. By contrast, stablecoin offramps allow users to sell stablecoins back into fiat currency.

Stablecoin onramps are used today in apps, products and services that use stablecoins for everyday p2p payments, cross-border remittances & transactions, store of value in developing economies, b2b payment solutions and much more. It’s an essential piece of infrastructure that users heavily rely on when using stablecoin-powered apps.

How to Choose a Stablecoin Onramp Infrastructure Partner

Businesses implementing stablecoins need to choose stablecoin onramp vendors that allow them to focus on their core business while reaping the benefits of stablecoins. The two main types of vendors are fully managed stablecoin onramps and stablecoin APIs. Let’s dive into the different stablecoin onramp offerings to get a better idea of which type of vendor should work best for you and your use case:

Fully Managed vs Stablecoin APIs

Fully Managed stablecoin onramps allow fintechs to implement stablecoins within minutes with tools like headless APIs, embedded widgets and hosted pop-ups. They typically handle payment processing, chargebacks, AML monitoring, KYC, and more.

On the other hand, stablecoin APIs leverage escrow bank accounts where fintechs deposit fiat currency, which is then converted to stablecoins like USDC and sent directly to end-user wallets when purchases are made.

While stablecoin APIs handle settlement, you are responsible for maintaining escrow funds, integrating fiat payment rails, implement anti-fraud measures, set up legal entities in the geographies you want to operate in, take on chargebacks/disuptes and run AML programs.

Integration Modality

There are three integration modalities to consider for implementing stablecoins within your fintech app: Headless, embedded or hosted.

- Headless APIs give you full control over the UI - allowing you to natively integrate stablecoins without compromising on your current user experience flows.

- Embedded widgets and hosted pop-ups allow you to integrate stablecoins and stablecoin onramps within 5 minutes by simply adding a button to your app - great for testing before committing to native integration.

Payment Methods

Your users will have to use either credit/debit card networks, ACH, or wire transfers to convert fiat into stablecoins so choosing a vendor that can accommodate for the payment methods that are most familiar with your userbase is important.

Geographic coverage

As regulation around stablecoins increases, stablecoin onramps need to collect licenses and build the proper local infrastructure in different geographies in order to stay compliant for themselves and their clients. Fintechs looking to run stablecoin operations need to consider what geographic coverage a stablecoin onramp vendor has, what custody models they support and which licenses (MTLs, MiCA, VASP, etc.) do they have.

Blockchain and Token coverage

Stablecoins are built on top of blockchains so it’s important to consider which ones your stablecoin onramp partner operates on and which tokens (stablecoins & cryptocurrencies) you and your users have access to.

Transaction Approval Rates & Settlement Time

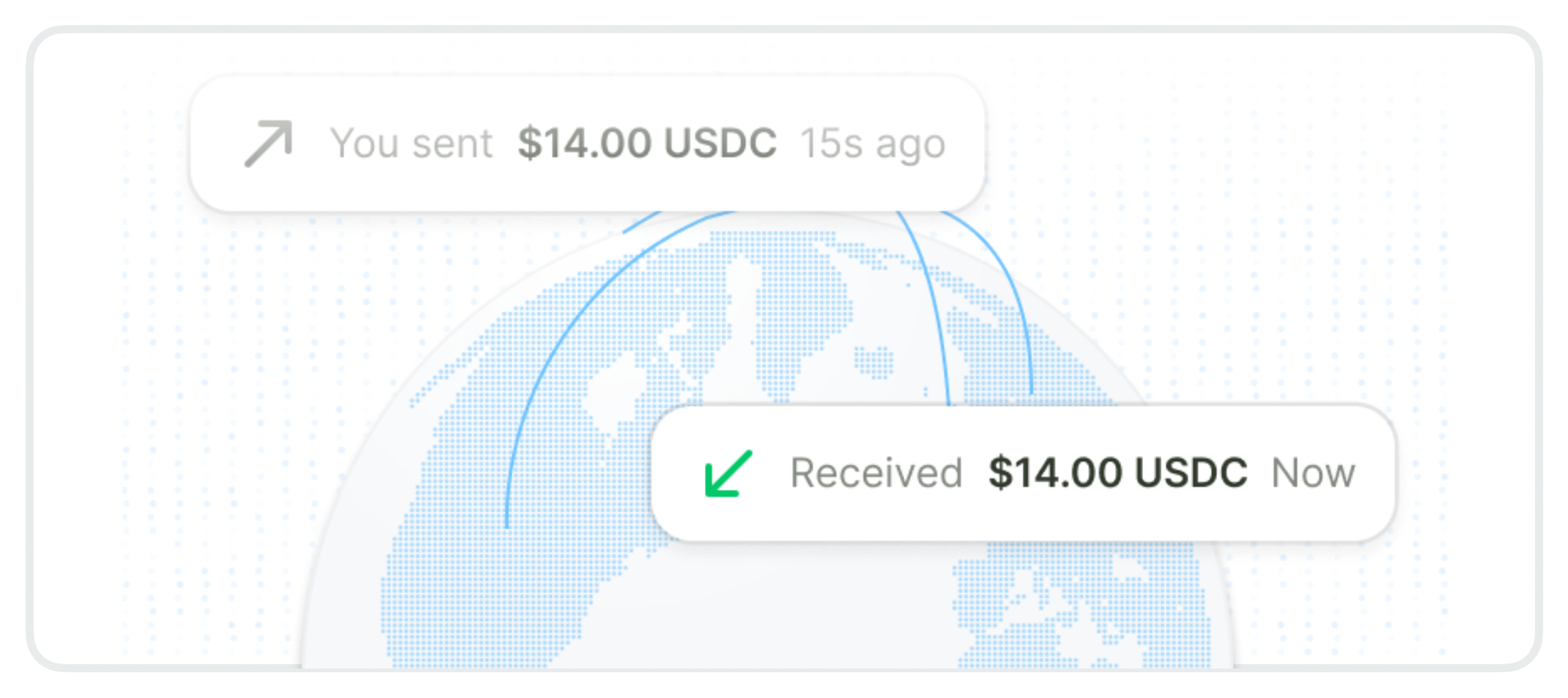

Finding a partner with transaction approval rates and settlement times that meet your standards is key to building a UX that retains users and keeps them happy. The best stablecoin onramp vendors should be able to deliver high transaction approval rates and low settlement times in the geographies that you want to operate in.

Platform Breadth

Implementing stablecoins and stablecoin onramps also require other tooling such as wallets which your users will need to hold and custody stablecoins and analytics dashboards which you will need to better understand how stablecoins are moving around within your ecosystem

Implementing Stablecoin Onramps & Bank-grade Wallets with Crossmint

After establishing your stablecoin implementation requirements, you may be inclined to find a full stack stablecoin implementation partner that can handle stablecoin onramps, wallets, compliance and more. Crossmint offers a comprehensive stablecoin solution that addresses all of your fundamental needs as a fintech company while providing enterprise-grade reliability.

With Crossmint, you can build secure stablecoin-powered apps with our fully managed stablecoin onramp and bank-grade wallets deployable through simple APIs and SDKs, scalable to millions of users. Our onramp allows your users to purchase stablecoins instantly and our programmable wallet infrastructure provides flexible signing options, accommodating various custody models while future-proofing against regulatory changes.

Key advantages of Crossmint’s Stablecoin Onramp include:

- Fully managed onramp that includes payment processing, chargeback protection, KYC/KYB, and AML screening

- Ability to launch with fully headless APIs to create flows that feel native to your app, or use embedded or hosted modalities to launch faster

- Regulatory compliance as a registered VASP in Europe with pending MiCA and MTL approvals

- Instant settlement times and best-in-class transaction success rates

- Global coverage and support for most non-sanctioned regions

- Track users and payments with unified dashboards

- Support for 40+ chains (most EVM chains), Solana, Sui, Aptos, and more

- Broad token support for stablecoins (USDC, USDT) and other cryptocurrencies

Key advantages of Crossmint’s Bank-grade Wallets include:

- Create wallets for users and companies in a few lines of code, client or server-side

- Bank-grade security & compliance with native AML monitoring, account recovery, flexible key management, secure transaction signing, spam filters, 2FA and more

- Use your own authentication or our authentication - easily deployed in just a few minutes

- Flexible custody models that include non-custodial, custodial and hybrid architectures that can be changed anytime with minimal user disruption

- No vendor lock-in so you can migrate providers at any time securely - no change in wallet address and no need to export keys

If you’re a fintech looking to implement stablecoins within your product, app or services, reach out to us here.