Fintechs offering treasury products, like B2B neobanks and corporate card platforms, are increasingly exploring digital asset rails to move money faster and cheaper. This requires integrating wallets for businesses and the first architectural choice these platforms face is deceptively simple: whether to use Externally Owned Accounts (EOAs) or Smart Wallets?

EOAs are straightforward—one key, one control, minimal complexity. But products evolve, platforms need flexibility: changing the architecture, rotating the keys, building new features, or modifying the custody model. At that point, you’re locked in—changes require creating new wallets and transferring all assets, which is particularly complicated if wallets are non-custodial.

Historically, most wallet providers relied on EOA architectures, where the private key and the wallet are inseparable. This architecture was the industry standard for years, but financial institutions working with stablecoin payment infrastructure have uncovered fundamental limitations. The next-generation of wallets are based on smart wallet architectures and decouple the wallet from the underlying keys.

How do smart contract wallets work for treasury infrastructure?

Smart wallets are programmable smart contract vaults built on open-source standards. You can set up different signers (API keys, TEEs, passkeys) to control the vaults. Signers can be added, removed, or rotated over time via API. These signers can be custodial or non-custodial, giving you the freedom to design whichever architecture best fits your need for each specific use case or geography.

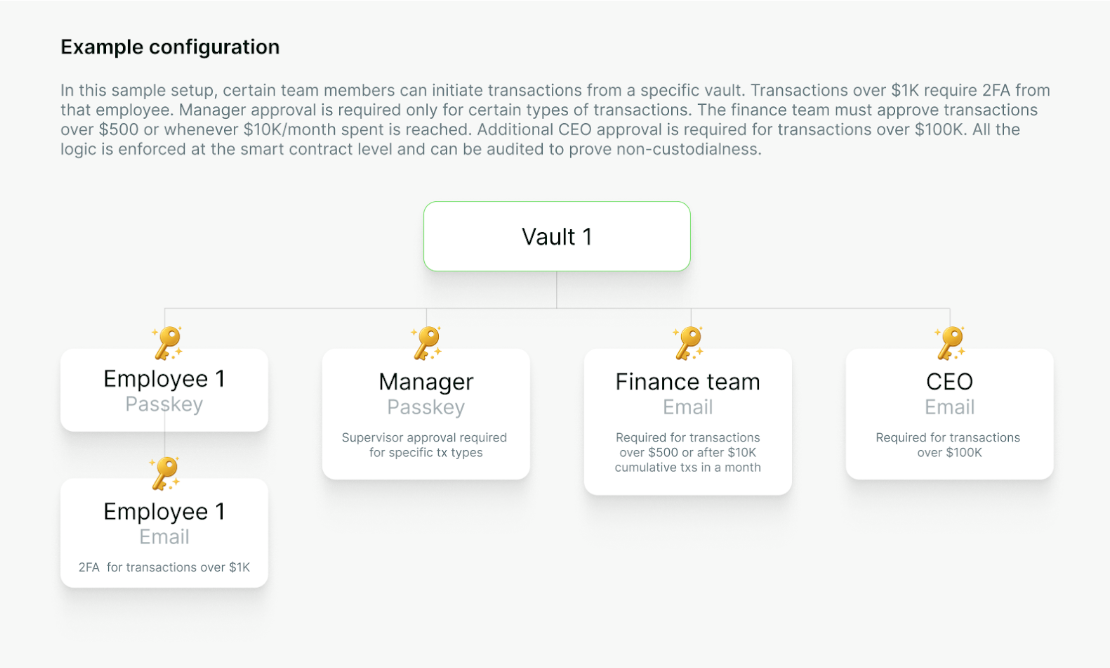

You can also set up programmable policies, such as:

- Role-based access: assign permissions based on function.

- Multi-sig: require multiple signers to approve a transaction

- Multi-factor authentication: add extra layers of security for sensitive operations.

These policies are enforced directly on the wallet’s smart contract with auditable code, allowing you to deploy more advanced functionality faster vs having to build your own backend.

What are the benefits of smart wallets for a treasury platform?

This decoupling unlocks maximum flexibility. You can alternate between custody models, switch providers, or bring operations fully in-house—all while keeping the same wallet and API. With most providers, such changes require creating new wallets, issuing new addresses, and migrating assets. With smart contract wallets, you simply rotate the signers on the contract.

Additionally, smart wallets are programmable, enabling functionality to be embedded directly into the wallet—from gas sponsorship to permissions, custom policies, and automated compliance controls.

Key benefits for treasury infrastructure:

- Programmable policies. Embed multi-signature requirements, role-based access, spending limits, and compliance controls directly on-chain.

- Flexible key management: select between different signer options or allow businesses to bring their own.

- No single point of failure: with EOAs, if the admin key of a wallet is lost or compromised, you must create new wallets/addresses, and migrate all assets. With smart wallets, you can simply add a new signer and revoke permissions from the former.

- No wallet migration when changing custody models. The same wallet address persists regardless of who controls the signers.

- No vendor lock-in. Switch custody providers or bring operations in-house without migrating assets.

- Gas sponsorship. Abstract blockchain complexity to create fiat-equivalent user experiences.

Ready to build with flexible wallet infrastructure?

Crossmint provides smart contract wallets with programmable governance, flexible custody, and integrated compliance for treasury platforms. Our infrastructure includes custodial and non-custodial wallets, AML screening, travel rule compliance, stablecoin orchestration, and fiat ramps in one API. Built on open-source standards and trusted by financial institutions like MoneyGram, Wirex, Santander, and Visa, Crossmint eliminates vendor lock-in with upgradable contracts you can self-host over time.

Reach out to us here to learn how wallet infrastructure and stablecoin payments can become your competitive advantage.