AI agents need to transact autonomously, but legacy payment rails weren't built for machines. Credit cards require human approval. Bank transfers take days to settle. API keys and subscription models assume a person is managing the account.

x402 fixes this by activating the dormant HTTP 402 status code to enable instant USDC payments directly over HTTP. The protocol requires minimal integration, charges zero protocol fees, and settles transactions in under two seconds.

While the protocol itself is straightforward, production-ready implementation means solving wallet custody, compliance, multi-chain support, and protocol abstraction. This guide covers the technical fundamentals, ecosystem positioning, how x402 companies like Crossmint are enabling the ecosystem and infrastructure requirements for building agent-accessible payment systems.

How does x402 work at the protocol level?

x402 revives HTTP's long-dormant 402 "Payment Required" status code. When Tim Berners-Lee and the HTTP Working Group reserved this code in the 1990s, they envisioned a web where servers could request payment for resources. Twenty-five years later, x402 makes that vision real.

The flow is simple:

- A client (human or agent) requests a resource from an x402-enabled server

- The server responds with HTTP 402 and includes payment requirements in the response body (price, accepted tokens, destination address)

- The client constructs a signed payment payload and retries the request with an

X-PAYMENTheader - A facilitator service verifies the payment on-chain and confirms validity

- The server returns the requested resource with an

X-PAYMENT-RESPONSEheader containing transaction details

Coinbase's hosted facilitator handles the blockchain infrastructure, so service providers don't need to run nodes, manage gas, or build settlement systems. The facilitator processes fee-free USDC payments on Base with two-second on-chain settlement and instant finality.

The architecture is trust-minimizing. Facilitators can't move funds beyond what clients explicitly authorize. Payment verification happens on-chain where anyone can audit the transaction history.

Because x402 extends native HTTP behavior, it works with any client (browsers, SDKs, AI agents, mobile apps) without changing your existing request-response flow. Add middleware to your server, and you're accepting payments.

Why x402 Matters for Agentic Commerce

"The biggest barrier to agentic commerce isn't the technology. It's that legacy payment rails weren't designed for machines. x402 solves this by extending HTTP 402 to support instant USDC payments, enabling AI agents to discover services, pay autonomously, and transact without human intervention."

— Alfonso Gomez Jordana, Cofounder @ Crossmint

This fundamental shift from human-centric to agent-native payments is why x402 represents critical infrastructure for the emerging agentic economy.

What's the difference between x402 and traditional payment APIs like Stripe?

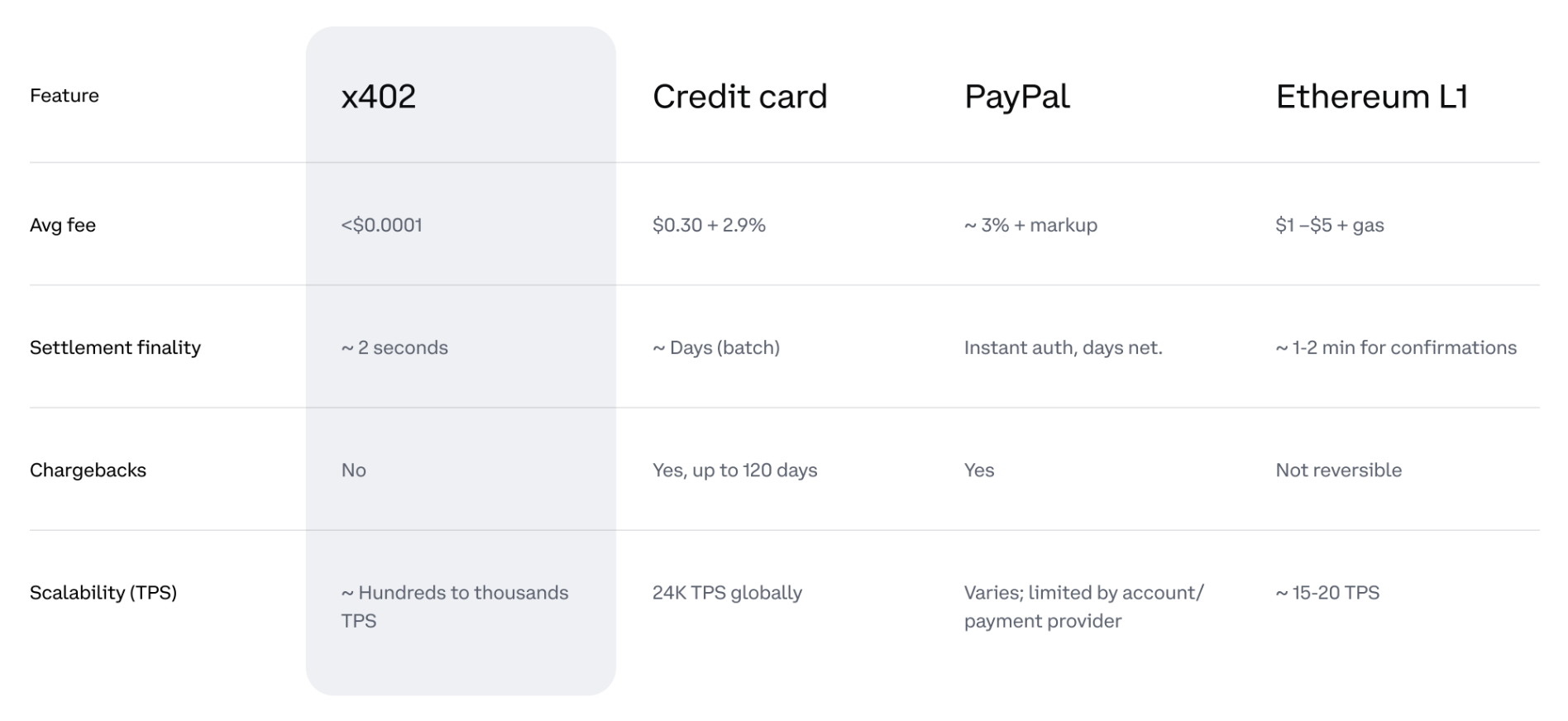

| Factor | x402 | Traditional Payment APIs |

|---|---|---|

| Account setup | None required | Merchant accounts, KYC |

| Transaction fees | Protocol: $0, Gas: <$0.0001 | 2.9% + $0.30 typical |

| Settlement time | 2 seconds | T+2 days |

| Micropayments | Viable at $0.001/request | Impractical below $1 |

| AI agent support | Native, no human required | Requires API keys, accounts |

| Vendor lock-in | Open protocol, any facilitator | Platform-specific |

The key differentiator is that x402 is a permissionless protocol, not a centralized service platform. No one outright owns x402. Compare that to Stripe, where you're dependent on a single company's infrastructure, pricing, and terms.

Traditional payment APIs assume humans are clicking buttons. They require account creation, authentication flows, and approval prompts. AI agents can't easily navigate these systems without workarounds.

x402 treats agents as first-class users. An agent with a wallet can discover a service, see the price in a 402 response, construct a payment, and access the resource without any human intervention.

When to use x402:

- Agent-to-agent payments where no human is involved

- Micropayments below $1 where traditional fees make transactions uneconomical

- Pay-per-use APIs that charge per request rather than subscriptions

- Crypto-native applications where users already have wallets

When to use Stripe:

- Human checkout flows with card payments

- Subscription billing and recurring revenue

- Traditional e-commerce requiring fiat currency

- Businesses needing extensive fraud detection for consumer transactions

Both have their place. Many companies will use both, depending on the use case.

How does x402 fit into Google's Agent Payments Protocol (AP2)?

Google's Agent Payments Protocol (AP2) is an open standard for AI agent payments backed by 60+ organizations. It supports multiple payment methods: cards, bank transfers, and stablecoins.

x402 operates as the stablecoin rail within AP2. While AP2 provides the framework through cryptographically-signed Mandates, x402 handles actual settlement when payments use USDC on Base.

x402 isn't competing with traditional payments. It's the crypto rail within Google's agent payments ecosystem, working alongside cards and bank transfers. x402 is production-ready today while traditional AP2 rails are still being built, giving early adopters positioning advantages.

What are the hidden challenges of implementing x402?

Here's where the gap between protocol elegance and production reality becomes clear.

Wallet Architecture

Agents need non-custodial smart wallets. Why? Giving an agent funds via an EOA (Externally Owned Account) that they control leads to insecure setups and private key management issues. Additionally, traditional custodial solutions defeat the purpose of agent autonomy.

With smart wallets (or smart accounts), we can achieve better experience and security allowing for delegated signers, approved spending limits and more while remaining non-custodial.

Multi-Protocol Future

It’s early days for agentic payments and we’re starting to see many different agentic payments protocols and standards launching. For companies that want to enable agentic commerce, partnering with a wallet infrastructure company will allow you to integrate multiple protocols through one simple API.

Compliance at Agent Scale

KYC and AML requirements don't disappear because agents are transacting. You need VASP licensing, Travel Rule compliance for cross-border flows, real-time transaction monitoring, and sanctions list checking. Agents can generate thousands of transactions per hour. Your monitoring systems need to handle that volume without introducing latency.

Multi-Chain Complexity

x402 currently supports Base only, but the roadmap includes multiple chains. Agents will need to transact across Ethereum, Polygon, Arbitrum, Solana, and whatever networks launch next. This means managing gas prices for each chain, bridging assets between networks, liquidity management, and different finality guarantees. Chain abstraction becomes essential.

Enterprise Security and Reliability

Production systems need SOC2 compliance, key management with hardware security modules, audit trails for every transaction, and disaster recovery procedures. Services discoverable via Bazaar need 99.99%+ uptime. You need global infrastructure for low-latency payments, rate limiting against malicious agents, and monitoring across both blockchain and HTTP layers.

The reality: you can integrate x402 with "a single line of code" for a proof of concept. Building production-ready agent payment infrastructure requires solving all these challenges simultaneously.

Build Agentic Payments Infrastructure with Crossmint

Crossmint provides stablecoin infrastructure and smart wallets that are purpose-built for the agentic economy:

- Smart wallets purpose-built for agent autonomy with programmable controls

- Multi-protocol support through unified API covering x402, AP2, and future standards

- 15+ blockchain networks with multi-stablecoin support (USDC, USDT, PYUSD)

- Enterprise compliance with VASP licensing, SOC2 Type II, and built-in KYC/AML

- Strategic partnerships with Google, Visa and more for early protocol access

- 99.99% uptime SLA with global infrastructure

Contact us here to learn how you can stay ahead of the curve with agentic payments